The SP and LSP Budget Calculator

The long-discussed Bill on Abolition of the MPF Offsetting Mechanism had passed the third reading on 9th June 2022. After the scheduled effective date in 2025, employers can no longer be allowed to use MPF contributions (the employer’s contribution portion) to deduct the Severance Payment (SP) and Long Service Payment (LSP) payable arising from the termination of employment.

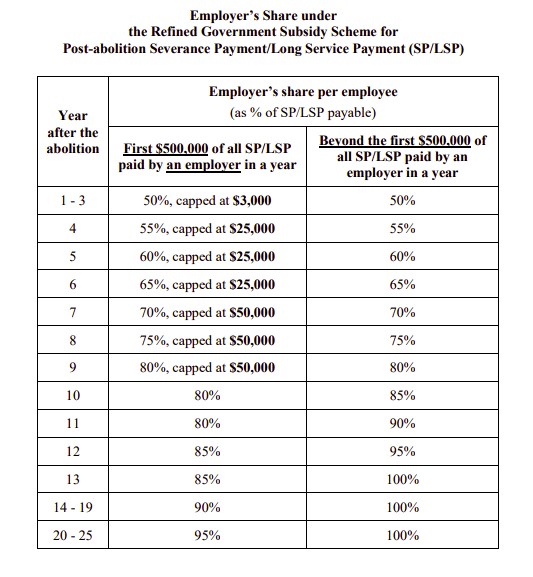

Under the new arrangement, the government will introduce a 25-year subsidiary scheme to aid employers to adapt. Employers will also need to make an additional contribution equal to 1% of the employee’s wage in the Designated Saving Account (DSA) set up on the eMPF platform henceforth. With the additional expenses and government funding, how much added financial expenses will employers bear from there onwards?

Employer’s Share under the Refined Government Subsidy Scheme for Post-abolition Severance Payment/Long Service Payment (SP/LSP)

Cityray has launched an “SP and LSP Budget Calculator”, which allows employers or HR to estimate the potential SP and LSP payable required after the effective date of the Ordinance, helping employers plan ahead.

Cityray’s “SP and LSP Budget Calculator”

Individual Estimation

By entering the hypothetical monthly wage before dismissal, years of employment, year of dismissal, and the estimated average monthly wage of the employee, the calculator outputs the estimated SP/LSP total amount, government subsidy amount, DSA payment amount and the employer’s payable balance.

Multitude Estimation

It is much the same as the individual estimate version. The main difference is that the user can input all staff’s specific monthly wage, years of employment and whether to be dismissed. Based on the staff’s specific monthly wage and years of employment on the selected list, the calculator outputs the estimated SP/LSP total amount, government subsidy amount, DSA payment amount and employer payable balance. Simultaneously, the breakdown of individual estimates for employees on the selected list is provided.

Please register HERE for access to the calculator.

——————————————————————————————————————–

*Disclaimer:

The calculated results are for reference purposes only. It cannot be used as the evidence in any legal dispute. Employers are required to calculate the LSP/SP in accordance with Employment Ordinance and be responsible for the legal liability.